Pacific Prime Can Be Fun For Anyone

Table of ContentsFacts About Pacific Prime UncoveredExamine This Report on Pacific PrimeThe Buzz on Pacific PrimeTop Guidelines Of Pacific PrimeEverything about Pacific Prime

Insurance policy is a contract, represented by a policy, in which a policyholder obtains monetary defense or reimbursement against losses from an insurance company. The firm swimming pools customers' risks to pay much more inexpensive for the insured. Many people have some insurance policy: for their auto, their house, their healthcare, or their life.Insurance additionally helps cover prices associated with obligation (lawful responsibility) for damages or injury triggered to a 3rd celebration. Insurance coverage is a contract (policy) in which an insurance company compensates another versus losses from certain contingencies or risks. There are numerous types of insurance coverage. Life, health and wellness, homeowners, and car are among the most usual kinds of insurance.

Investopedia/ Daniel Fishel Numerous insurance coverage types are readily available, and practically any private or service can find an insurance provider ready to guarantee themfor a price. Usual personal insurance coverage plan types are automobile, wellness, home owners, and life insurance. Many people in the USA have at least one of these types of insurance, and car insurance coverage is required by state regulation.

Pacific Prime - An Overview

Finding the cost that is appropriate for you requires some research. Maximums might be established per period (e.g., annual or policy term), per loss or injury, or over the life of the plan, additionally recognized as the lifetime maximum.

Policies with high deductibles are usually more economical due to the fact that the high out-of-pocket expenditure usually leads to less small cases. There are various kinds of insurance. Allow's take a look at the most vital. Health insurance policy helps covers regular and emergency situation healthcare prices, typically with the alternative to add vision and oral solutions independently.

Many precautionary services might be covered for complimentary prior to these are satisfied. Health and wellness insurance coverage might be bought from an insurance coverage business, an insurance policy agent, the federal Health and wellness Insurance policy Marketplace, offered by an employer, or federal Medicare and Medicaid protection.

Pacific Prime - Questions

Rather of paying out of pocket for auto crashes and damage, people pay annual premiums to an automobile insurance provider. The business then pays all or most of the protected costs connected with an automobile crash or various other automobile damages. If you have actually a leased car or borrowed cash to get an auto, your loan provider or renting dealership will likely need you to bring automobile insurance.

A life insurance policy assurances that the insurance firm pays a sum of cash to your beneficiaries (such as a spouse or youngsters) if you pass away. In exchange, you pay costs during your lifetime. There are 2 primary types of life insurance coverage. Term life insurance policy covers you for a details duration, such as 10 to twenty years.

Insurance is a method to manage your monetary threats. When you acquire insurance coverage, you acquire defense versus unanticipated financial losses.

The Greatest Guide To Pacific Prime

There are many insurance plan types, some of the most common are life, health and wellness, homeowners, and car. The best Visit Website kind of insurance policy for you will certainly rely on your objectives and economic situation.

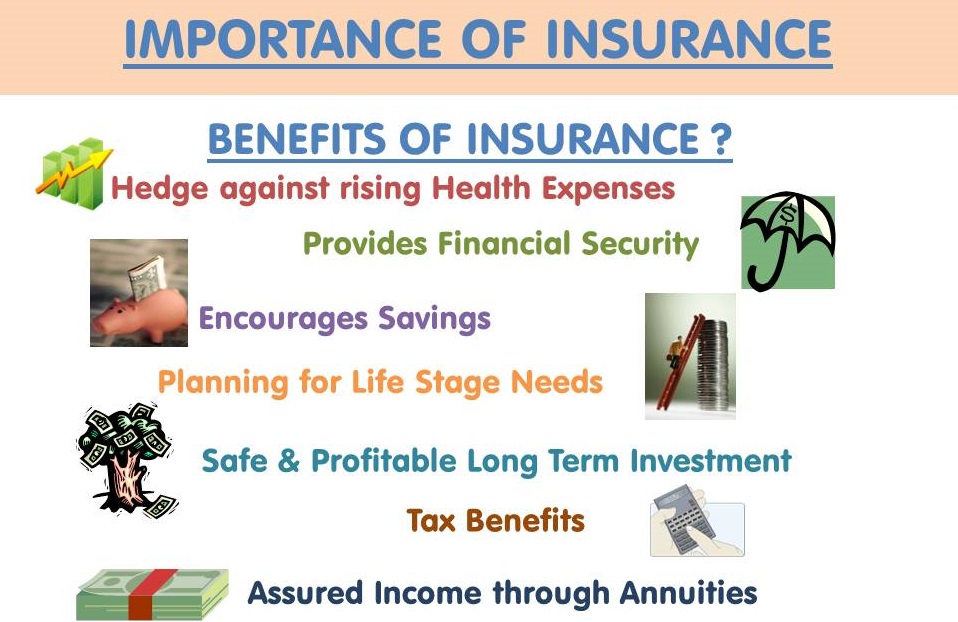

Have you ever before had a minute while looking at your insurance coverage or searching for insurance coverage when you've thought, "What is insurance? And do I really require it?" You're not alone. Insurance policy can be a strange and confusing thing. Exactly how does insurance policy job? What are the benefits of insurance? And exactly how do you locate the very best insurance for you? These prevail questions, and the good news is, there are some easy-to-understand answers for them.

No one wants something negative to take place to them. Yet experiencing a loss without insurance can put you in a hard monetary situation. Insurance coverage is a vital monetary device. It can help you live life with less worries understanding you'll obtain monetary support after a calamity or accident, helping you recoup quicker.

An Unbiased View of Pacific Prime

And in some cases, like automobile insurance and workers' compensation, you may be needed by law to have insurance coverage in order to safeguard others - maternity insurance for expats. Learn more about ourInsurance alternatives Insurance is essentially an enormous wet day fund shared by many individuals (called insurance policy holders) and taken care of by an insurance policy service provider. The insurance provider makes use of cash collected (called costs) from its insurance holders and other financial investments to spend for its procedures and to meet its pledge to insurance holders when they file a case

Comments on “Some Known Details About Pacific Prime”